Delving into Discount Car Insurance Quotes: Tips for High-Risk Drivers in Canada, this introduction immerses readers in a unique and compelling narrative, with a focus on helping high-risk drivers navigate the complexities of finding affordable insurance coverage.

Exploring the factors that define high-risk drivers and the importance of seeking discount car insurance quotes, this guide aims to provide valuable insights for drivers in Canada looking to save on insurance costs.

Understanding High-Risk Drivers

High-risk drivers are individuals who are more likely to be involved in accidents or file claims, leading insurance companies to perceive them as a higher financial risk. This perception often results in higher insurance premiums for these drivers.

Factors that Classify a Driver as High-Risk

Several factors can contribute to classifying a driver as high-risk. These include:

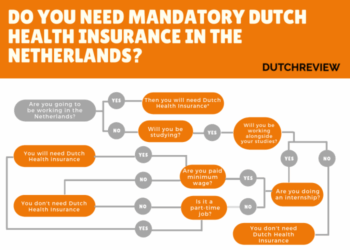

- History of accidents: Drivers who have been involved in multiple accidents are often considered high-risk.

- Traffic violations: Repeated traffic violations, such as speeding tickets or reckless driving charges, can also lead to being classified as high-risk.

- DUI convictions: Driving under the influence (DUI) convictions significantly increase the risk level of a driver.

- Youthful or elderly drivers: Young and elderly drivers are often considered high-risk due to lack of experience or potential physical limitations.

How Insurance Companies Determine Risk Levels

Insurance companies use various factors to determine the risk levels of drivers. These factors may include:

- Driving record: Insurance companies assess a driver's history of accidents, traffic violations, and claims to gauge risk levels.

- Age and experience: Young or inexperienced drivers are typically viewed as higher risk compared to older, more experienced drivers.

- Vehicle type: The make and model of the vehicle being insured can also impact the risk level, as certain vehicles may be more prone to accidents.

Importance of Discount Car Insurance Quotes

When it comes to high-risk drivers in Canada, seeking discount car insurance quotes is crucial. These quotes can provide significant benefits that help high-risk drivers save money on insurance premiums and find the best coverage options for their specific needs.

Significance of Seeking Discount Car Insurance Quotes

Comparing discount car insurance quotes allows high-risk drivers to explore different options available in the market. By obtaining multiple quotes, drivers can get a better understanding of the pricing, coverage, and discounts offered by various insurance companies.

- Discount quotes help high-risk drivers save money: By comparing quotes, drivers can identify cost-effective insurance options that suit their budget while still providing adequate coverage.

- Opportunity to find specialized coverage: Discount quotes enable high-risk drivers to find insurance companies that specialize in providing coverage for drivers with a less-than-perfect driving record.

- Increased chances of finding discounts: By exploring multiple quotes, drivers can uncover potential discounts or savings opportunities that they may not have been aware of initially.

Tips for High-Risk Drivers Seeking Discount Car Insurance Quotes

High-risk drivers face challenges when it comes to getting affordable car insurance quotes. However, there are strategies they can implement to increase their chances of securing discounts and lower rates.

Maintain a Clean Driving Record

Having a clean driving record is crucial for high-risk drivers looking for discount car insurance quotes. Insurance companies often offer lower rates to those who have a history of safe driving without accidents or traffic violations. By avoiding speeding tickets, accidents, and other infractions, high-risk drivers can demonstrate their commitment to safe driving and potentially qualify for discounts.

Attend Defensive Driving Courses

One effective way for high-risk drivers to improve their chances of getting discount car insurance quotes is by attending defensive driving courses. These courses provide valuable knowledge and skills that can help drivers become safer on the road. Insurance companies may view individuals who have completed defensive driving courses as lower risk, which could lead to lower insurance rates.

Comparing Insurance Providers

When it comes to high-risk drivers in Canada, finding the right car insurance provider is crucial. Researching and comparing different insurance companies can help high-risk drivers secure the best coverage for their needs.

Looking beyond Premium Cost

- Consider Coverage Options: Look beyond just the premium cost and assess the coverage options provided by different insurance providers. Ensure that the policy offers adequate coverage for your specific needs as a high-risk driver.

- Check Policy Details: Review the policy details carefully to understand what is covered and what is excluded. Pay attention to any limitations or restrictions that may impact your coverage.

- Compare Discounts: In addition to the premium cost, compare the discounts offered by different insurance companies. Some providers may offer discounts for factors such as safe driving habits or completing a defensive driving course.

Assessing Reliability and Reputation

- Read Customer Reviews: Look for reviews and testimonials from other high-risk drivers to gauge the reliability and customer service of insurance providers. Positive reviews can indicate a company that is responsive and helpful when dealing with claims.

- Check Financial Stability: Assess the financial stability of insurance companies by reviewing their credit ratings. A financially stable provider is more likely to fulfill claims and provide timely payouts.

- Research Complaints: Research any complaints or negative feedback about insurance companies through consumer advocacy websites or regulatory agencies. Avoid providers with a history of unresolved complaints or poor customer satisfaction.

Outcome Summary

In conclusion, navigating the world of car insurance as a high-risk driver in Canada can be challenging, but with the right tips and strategies, it is possible to find affordable coverage. By understanding the significance of discount quotes and implementing best practices, high-risk drivers can secure the insurance they need without breaking the bank.

Questions and Answers

How do insurance companies determine risk levels for drivers?

Insurance companies assess risk levels based on factors such as driving history, age, vehicle type, and location.

What are some strategies for high-risk drivers to improve their chances of getting affordable quotes?

High-risk drivers can consider taking defensive driving courses, maintaining a clean driving record, and comparing quotes from multiple insurance providers.

Why is it important to look beyond just the premium cost when evaluating insurance options?

Looking at factors like coverage limits, deductibles, and customer service can help high-risk drivers choose the best insurance provider for their needs.