Starting off with Automotive Insurance Quote Trends in Saudi Arabia – What’s Changing?, this introductory paragraph aims to grab the readers' attention and provide a brief overview of the topic.

Following that, the subsequent paragraph will delve deeper into the details and intricacies of the subject matter.

Overview of Automotive Insurance in Saudi Arabia

Automotive insurance in Saudi Arabia plays a crucial role in protecting both drivers and vehicles on the road. It provides financial coverage in the event of accidents, theft, or damage to vehicles, ensuring that individuals are not burdened with hefty expenses.

Key Players in the Automotive Insurance Industry

- Saudi Arabian Cooperative Insurance Company (SAICO)

- Tawuniya Insurance Company

- AXA Cooperative Insurance Company

These are some of the prominent insurance companies operating in Saudi Arabia that offer a range of automotive insurance products to cater to the diverse needs of drivers in the country.

Importance of Having Automotive Insurance in Saudi Arabia

- Legal Requirement: It is mandatory by law to have automotive insurance in Saudi Arabia to drive legally on the roads.

- Financial Protection: Automotive insurance provides financial protection against unforeseen events such as accidents or theft, reducing the financial burden on the policyholder.

- Peace of Mind: Having automotive insurance gives drivers peace of mind knowing that they are covered in case of any unfortunate incidents on the road.

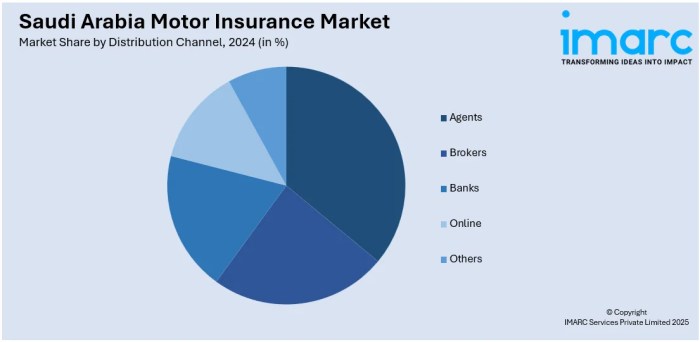

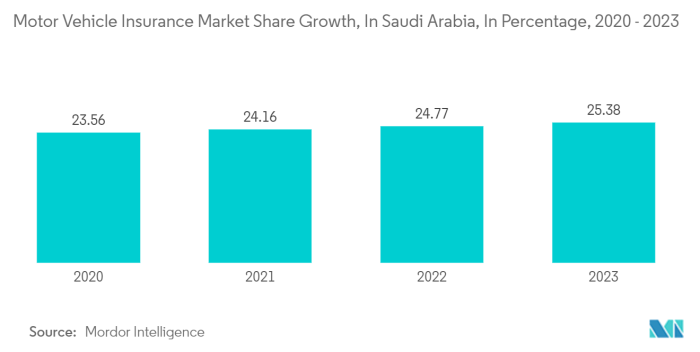

Trends in Automotive Insurance Quotes

Automotive insurance quotes in Saudi Arabia have been experiencing noticeable trends in recent times. Let's delve into the evolving landscape of pricing strategies and technological advancements shaping the generation of insurance quotes.

Pricing Strategies of Different Insurance Providers

Insurance providers in Saudi Arabia are adopting various pricing strategies to attract customers and stay competitive in the market. Here are some common approaches:

- Some insurers offer discounted rates for customers with a clean driving record, encouraging safe driving habits.

- Others may provide bundled packages that combine auto insurance with other types of coverage, such as home or health insurance, offering cost savings to policyholders.

- Dynamic pricing models are also gaining popularity, where premiums are adjusted based on individual driving behavior captured through telematics devices installed in vehicles.

Advancements in Technology and Quote Generation

Technological advancements are revolutionizing the way insurance quotes are generated in Saudi Arabia, making the process more efficient and personalized. Here are some key developments:

- Online platforms and mobile apps now allow customers to receive instant quotes by inputting their vehicle and personal information, eliminating the need for lengthy paperwork.

- Artificial intelligence and machine learning algorithms are being utilized to analyze data and calculate risk factors more accurately, leading to more precise pricing for insurance policies.

- Integration of big data analytics enables insurers to assess customer behavior patterns and tailor insurance quotes accordingly, enhancing customer satisfaction and retention.

Factors Influencing Insurance Premiums

When it comes to determining insurance premiums for automotive coverage in Saudi Arabia, several factors play a crucial role in shaping the quotes that individuals receive. These factors can vary from demographic variables to vehicle-related aspects, all of which contribute to the final premium amount that policyholders have to pay.Demographic variables such as age, gender, and location are significant determinants of insurance premiums in Saudi Arabia.

Younger drivers, especially those under the age of 25, tend to face higher insurance costs due to their increased likelihood of being involved in accidents. Similarly, male drivers typically pay more for insurance compared to their female counterparts, as statistics show that men are more prone to risky driving behaviors.

Additionally, the location where a vehicle is primarily driven also influences insurance quotes, with urban areas usually associated with higher premiums due to higher traffic density and increased risk of accidents

Luxury cars and high-performance vehicles generally come with higher insurance costs due to their expensive repair and replacement parts. Similarly, vehicles used for commercial purposes or long-distance commuting are considered higher risk and therefore attract higher premiums. Additionally, a vehicle's history, including previous accidents or claims, can also affect insurance premiums, with a history of accidents leading to increased costs.

Role of Vehicle Type

The type of vehicle being insured is a key factor in determining insurance premiums. Luxury cars, sports cars, and high-end vehicles typically come with higher insurance costs due to their higher value and expensive repair and replacement parts. On the other hand, economical and low-risk vehicles are associated with lower insurance premiums as they are cheaper to repair and replace in case of an accident.

Impact of Usage

The way a vehicle is used also plays a significant role in shaping insurance premiums. Vehicles used for commercial purposes, such as taxis or delivery vehicles, are considered higher risk and therefore attract higher insurance costs. On the other hand, vehicles used for personal use and limited mileage are associated with lower premiums as they are less likely to be involved in accidents.

Importance of Vehicle History

A vehicle's history, including previous accidents, claims, and maintenance records, can impact insurance premiums. Vehicles with a history of accidents or claims are considered higher risk and therefore attract higher insurance costs. Conversely, vehicles with a clean history and regular maintenance records are associated with lower premiums as they are perceived as lower risk by insurance companies.

Digital Transformation in Insurance

Digital transformation is revolutionizing the insurance industry in Saudi Arabia, particularly in how insurance quotes are offered to consumers. This shift towards digital tools and platforms has streamlined the process, making it more convenient and efficient for both insurance providers and customers.

Digital Tools and Platforms

- Insurance Mobile Apps: Many insurance companies in Saudi Arabia now offer mobile apps that allow customers to easily request quotes, manage policies, and file claims directly from their smartphones.

- Online Comparison Websites: Platforms like Souqalmal and Aqeed have made it simple for consumers to compare different insurance quotes online, helping them find the best coverage at competitive rates.

- AI and Chatbots: Artificial intelligence and chatbots are being used by insurance companies to provide instant customer support, answer queries, and assist in the quote generation process.

Benefits and Challenges of Digitizing Insurance

- Digitalization Benefits:

- Convenience: Customers can easily access insurance information and quotes anytime, anywhere.

- Efficiency: The process of obtaining quotes, purchasing policies, and filing claims is faster and more streamlined.

- Cost-Effective: Digital tools help insurance companies reduce operational costs, which can lead to more competitive premiums for customers.

- Digitalization Challenges:

- Data Security: With more personal information being shared online, there is an increased risk of data breaches and cyber attacks.

- Lack of Personalization: Some customers may prefer a more personalized approach to insurance, which can be challenging to achieve in a fully digital process.

- Digital Divide: Not all customers may have access to the internet or be comfortable using digital platforms, which can create barriers to accessing insurance services.

Epilogue

In conclusion, this final paragraph will wrap up the discussion by summarizing the key points and leaving the readers with some food for thought.

User Queries

What factors impact insurance premiums in Saudi Arabia?

Various factors such as age, gender, location, vehicle type, usage, and history influence insurance premiums in Saudi Arabia.

How is digital transformation changing insurance quotes in Saudi Arabia?

Digital transformation is revolutionizing the insurance industry by offering more efficient and user-friendly ways to generate insurance quotes in Saudi Arabia.

Why is having automotive insurance important in Saudi Arabia?

Automotive insurance is crucial in Saudi Arabia to protect individuals from financial losses in case of accidents and ensure compliance with legal requirements.