As Shop Car Insurance Quotes: Multi-Country Comparison (US, UK, India) takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Exploring the nuances of car insurance quotes across different countries sheds light on the varied factors influencing rates and the process of obtaining and comparing these quotes.

Overview of Car Insurance Quotes Comparison

When it comes to car insurance, comparing quotes across different countries is essential to ensure you are getting the best coverage at the most competitive price. Each country has its own set of factors that influence car insurance quotes, making it important to understand the differences between the US, UK, and India.

Factors Influencing Car Insurance Quotes

Several factors can influence car insurance quotes in the US, UK, and India. These factors include:

- Driving history and experience

- Type of coverage required

- Type of vehicle being insured

- Age and gender of the driver

- Location of the insured individual

Process of Obtaining and Comparing Car Insurance Quotes

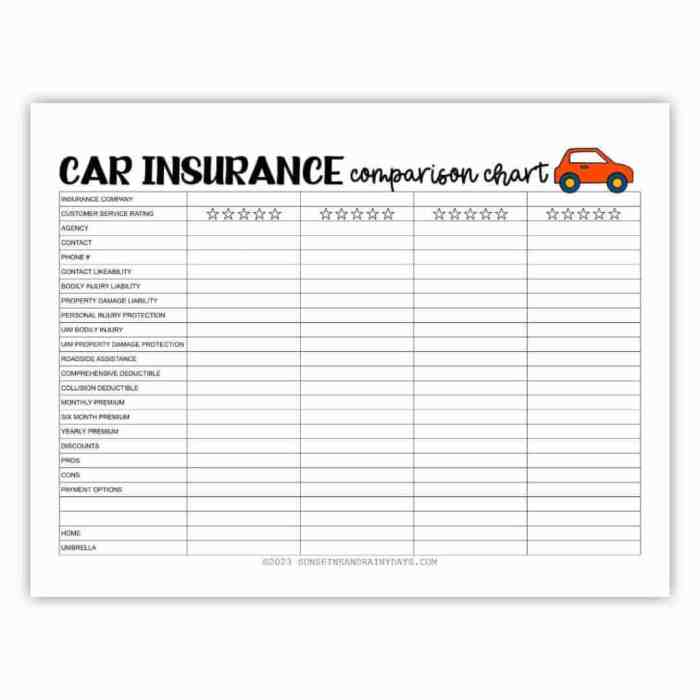

Obtaining and comparing car insurance quotes involves requesting quotes from multiple insurance providers and analyzing the coverage and premium costs offered. It is important to carefully review the terms and conditions of each policy to ensure you are selecting the best option for your needs.

Car Insurance Market in the US

The car insurance market in the US is a highly competitive and regulated industry that offers a wide range of options to consumers. With each state having its own set of regulations governing car insurance, it is essential for drivers to understand the key aspects of this market to make informed decisions.

Popular Insurance Providers in the US

- State Farm: One of the largest car insurance companies in the US known for its extensive coverage options and personalized service.

- GEICO: Offers affordable rates and a user-friendly online platform for managing policies.

- Progressive: Known for its innovative tools like Snapshot, which tracks driving habits to potentially lower premiums.

- Allstate: Provides various discounts and rewards programs for safe driving.

Unique Features and Regulations

- Minimum Coverage Requirements: Each state in the US has specific minimum coverage requirements that drivers must adhere to.

- No-Fault Insurance: Some states follow a no-fault insurance system where drivers turn to their own insurance provider for coverage regardless of fault in an accident.

- Usage-Based Insurance: Many insurers offer usage-based insurance programs that use telematics devices to track driving behavior and adjust premiums accordingly.

Car Insurance Market in the UK

The car insurance market in the UK is known for its competitive nature and wide range of offerings. With a strong emphasis on consumer choice and protection, the UK insurance market operates under strict regulatory guidelines to ensure fair practices and transparency for policyholders.

Characteristics of the UK Car Insurance Market

- Comprehensive coverage options: UK car insurance policies often offer a variety of coverage options, including third-party, third-party fire and theft, and comprehensive coverage.

- No-fault claims system: Unlike the US, the UK operates on a no-fault claims system, where each driver's insurance company pays for their own damages regardless of who caused the accident.

- Telematics and black box insurance: The UK has seen a rise in popularity of telematics-based insurance policies, where premiums are based on actual driving behavior monitored through a black box device installed in the vehicle.

Differences Between US and UK Car Insurance Policies and Pricing

- Minimum coverage requirements: While both countries require liability insurance, the minimum coverage amounts and types of coverage vary between the US and UK.

- Claim process: The claims process in the UK is often more straightforward and efficient compared to the US, with a focus on quick resolution and customer satisfaction.

- Premium factors: Factors influencing car insurance premiums in the UK may differ from those in the US, with considerations such as age, driving experience, and location playing a significant role in pricing.

Notable Trends in the UK Insurance Market

- Rise of insurtech: The UK insurance market has seen an increase in the adoption of technology-driven solutions to enhance customer experience and streamline processes.

- Shift towards green initiatives: With a growing emphasis on sustainability, some UK insurance companies offer discounts for eco-friendly vehicles or promote green driving practices.

- Regulatory changes: Recent regulatory changes in the UK insurance market aim to improve transparency, consumer protection, and fair competition among insurance providers.

Car Insurance Market in India

India has a growing car insurance market with a variety of options available for consumers. Let's take a closer look at the car insurance industry in India and compare it with the US and UK.

Types of Car Insurance in India

In India, car insurance can be broadly classified into two main types: third-party liability insurance and comprehensive insurance. Third-party liability insurance is mandatory by law and covers damages to a third party in case of an accident. On the other hand, comprehensive insurance provides coverage for both third-party liability as well as damages to your own vehicle.

This is similar to the types of car insurance available in the US and UK.

Factors Affecting Car Insurance Costs in India

Several factors contribute to the cost of car insurance in India. These include the age and model of the vehicle, the driver's age and driving history, the location where the car is registered, and the coverage type chosen. Additionally, factors like the presence of anti-theft devices, safety features, and voluntary deductibles can also impact the premium amount.

Overall, the cost of car insurance in India is influenced by similar factors as in the US and UK, but the rates may vary based on the specific market conditions in each country.

Epilogue

Concluding our discussion on Shop Car Insurance Quotes: Multi-Country Comparison (US, UK, India) unveils the complexities of the insurance market and the diverse elements impacting car insurance costs worldwide.

FAQ Insights

What factors influence car insurance quotes in different countries?

Car insurance quotes can vary based on factors like local regulations, driving habits, vehicle type, and insurance company policies.

Are there any unique features in the US car insurance market?

The US market offers a wide range of coverage options, discounts, and state-specific regulations that impact insurance rates.

What are the notable trends in the UK insurance market?

The UK market shows a growing trend towards telematics-based insurance and an emphasis on safe driving practices to lower premiums.

How does the car insurance industry operate in India?

The Indian market is marked by a mix of public and private insurance companies offering various types of coverage tailored to local needs.